Small framework to price one factor options using binomial lattices.

This project is part of my computational finance and C++ studies.

The design uses the layered approach:

- Layer 1 - Lattice model

- Layer 2 - Back and forward induction

- Layer 3 - Model and pricing functions

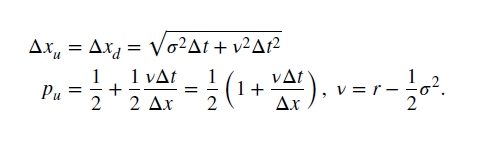

Asset/option calculation implements the Trigeorgis (TRG) model:

The lattice is implemented using boost UBLAS triangular matrix.